Embedded Finance

Introduction

Our Embedded Finance API provides a robust suite of services designed to streamline the management of customers, accounts, payment and onboarding processes. The API is organised into six core services:

Requests: A flexible API for managing requests that offers real-time updates on asynchronous operations.

Customers: Easily manage your customers linked to your partner account.

Accounts: Effortlessly track user accounts, simplifying the handling of financial transactions within your application.

Payments: Execute payments seamlessly, allowing your users to make transactions without leaving your app.

Notifications: Receive real-time updates on payments and onboardings.

Onboarding: Seamlessly onboard your clients, providing you with a customer reference and a ready-to-use multicurrency account.

Requests Manager

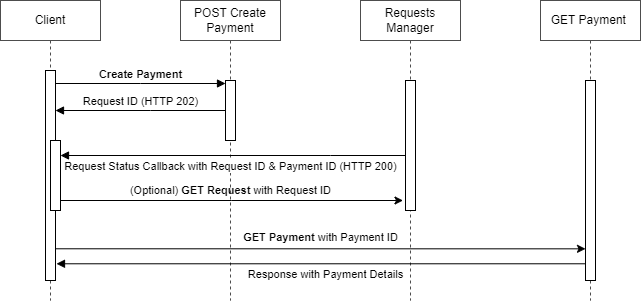

When you send a request to the Embedded Finance API, the system registers it and synchronously assigns a unique request ID. This ID is essential for monitoring the real-time processing status of your request, allowing you to track its journey from initiation to completion and ensuring full visibility throughout the process.

Once the request is completed, the system sends a callback containing a reference to the specific entity created, such as a payment reference.

A sample callback for a payment might look like this:

{

"requestId": "2b3fefaf-ac32-4b9e-a266-b0f7ac01fd4c",

"requestTimeStamp": "2024-04-22T01:25:04Z",

"status": "Andaria.Statuses.Accepted"

}The below example illustrates the use of the above for a Create Payment flow.

On success, the reference is returned in the entityId field, whether it’s a payment reference, account reference, etc., depending on your action.

{

"entityId": "AADO09180000002",

"entityLocation": "https://api-sandbox.andaria.com/payments-services/v2/payments/AADO09180000002",

"requestId": "222febd2-a511-4b56-895f-7fe043aabc70",

"status": "Andaria.Statuses.Completed",

"errorDescription": []

}On failure, a list of errors is returned in the errorDescription field.

{

"entityId": "",

"entityLocation": "",

"requestId": "b4dc2d4a-5abd-411f-b537-87df2788f3c7",

"status": "Andaria.Statuses.CompletedWithErrors",

"errorDescription": [ "Date must be within the next 7 days!" ]

}Onboarding Service

Our Onboarding Service allows you to seamlessly onboard your clients. A single onboarding request initiates a four-stage process, after which your client is successfully onboarded. At completion, you will receive a unique customer reference and account reference for their newly created multi-currency account. For detailed instructions, please refer to our Getting Started page.

Customers Service

After successfully creating a customer using our Onboarding API, you will receive a unique customer reference via webhook. This reference allows you to perform strong customer authentication requests and query the customer's information.

Accounts Service

Upon successfully creating a customer using our Onboarding API, an account will be generated automatically, and you will receive the unique account reference via webhook. If you were onboarded manually, you can utilize the Accounts Service to create a new account.

During the account creation process, we will assign account numbers, which you can easily retrieve through the Accounts Service. The account will be ready to receive incoming payments immediately. Additionally, the Accounts Service enables you to make updates, such as renaming or closing accounts, and perform other operations like retrieving statements and checking balances.

Payments Service

Andaria offers four types of payments: receiving incoming payments, making outgoing payments, peer-to-peer payments between Andaria customers, and account-to-account transfers.

For incoming payments, we provide a real-time webhook notification as soon as funds are credited to your customer's account.

Outgoing payments, made by your customers to third parties, are routed through various networks such as SEPA, SWIFT, or Faster Payments, depending on the region and currency.

When you initiate a payment request, a request ID is generated as outlined in the "Requests" section, and a payment ID will be issued once the payment is completed. You can also subscribe to webhooks via the Notification Services, providing an endpoint to receive real-time updates.

Notification Service

Our notification service, powered by webhooks, keeps you informed with real-time updates. You can subscribe to specific events, like onboarding updates, allowing your system to automatically respond to changes in the onboarding process. Notifications are delivered in real time and can be sent through various channels based on your preferences.

Responses

All POST or PATCH requests are asynchronous endpoints. The responses will return a 202 - Accepted status. When you poll the Request Manager, you can expect to receive either a 200 OK, indicating that the request was completed, or a 400 Bad Request, indicating that the request was not completed due to errors.

All GET requests are synchronous endpoints. The responses will return either an HTTP 200 OK for successful requests, which includes an Andaria status code within the response payload: 200 when data is returned and 204 when no data is returned. If the request is invalid, the response will be HTTP 417 Expectation Failed.